In fall 2015, Josh Luber ascended the TED stage to talk about his passion: sneakers.

Josh was the founder of Campless, a “Kelley Blue Book” for sneaker resale. Campless scraped eBay data for more than 25 million sneaker transactions, and analyzed price, volume, and volatility. The site gave sellers real-time insights into what to sell (and when), and gave buyers a sense of fair pricing.

As Josh told the TED audience, he saw an even bigger opportunity - creating a commerce platform for the sneakerheads who treated their shoes like stocks, spending hours a day on their “portfolios." He was greeted with disbelieving laughter.

Though he didn’t reveal it at the time, Josh was already well on his way to launching this. He had spent the past three years building Campless as a side project while working full-time in strategy at IBM - waking up at 4 a.m. to update the site before rushing to work. In June 2015, Josh quit his job after meeting Dan Gilbert, founder of Quicken Loans and owner of the Cleveland Cavaliers. Dan shared Josh’s vision of turning Campless into the “stock market for things,” starting with sneakers.

In December 2015, Josh and Dan started onboarding beta testers to their new sneaker resale marketplace, which would become StockX. These users were active - the first 500 posted more than 500 listings in a month. And two months later, StockX made its public debut! It was the #5 product of the day on ProductHunt. Special shoutout to Ian (@bugaboosal), who made a prescient comment on launch day.

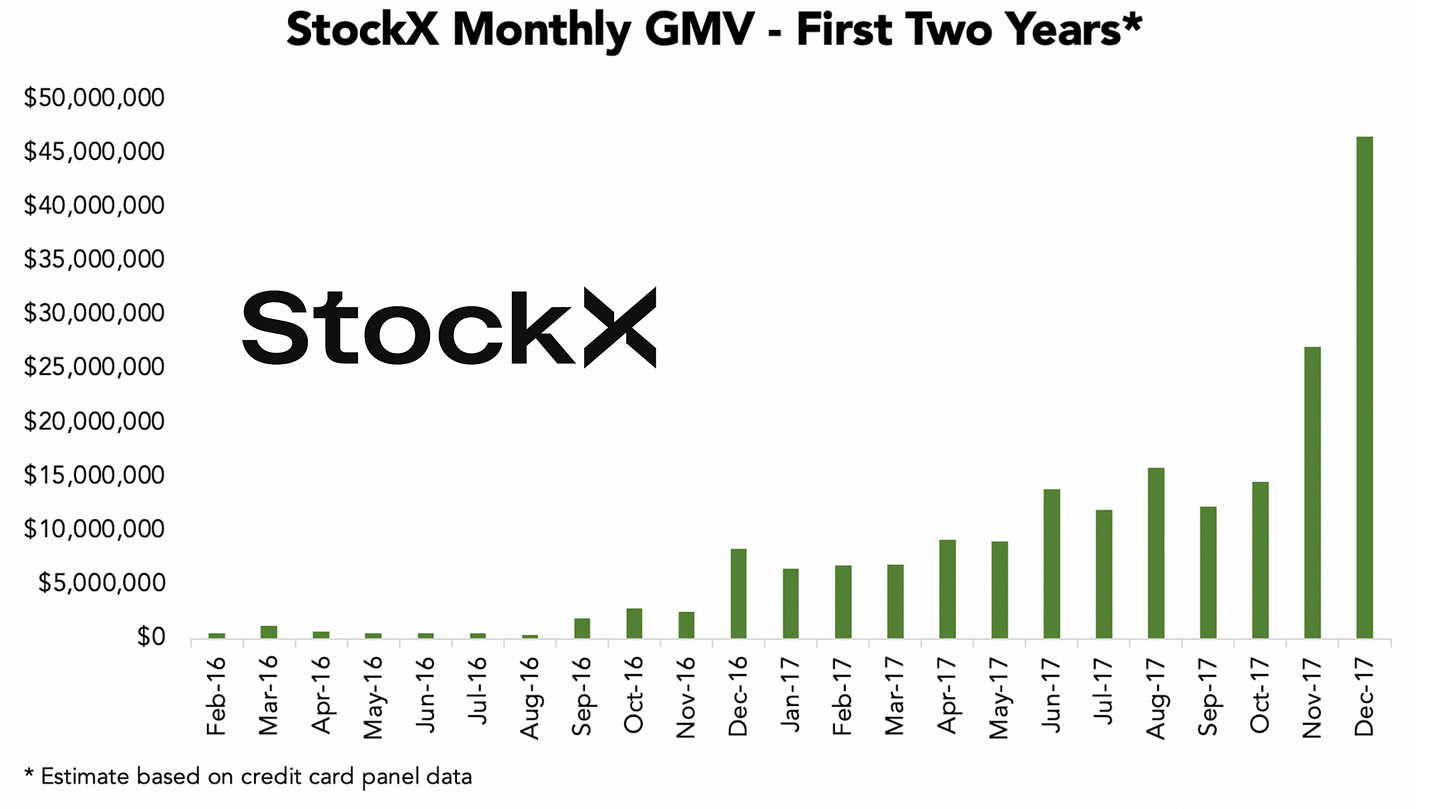

Just like the Nike swoosh, StockX’s journey has been “up and to the right” since then. In 2020, StockX did $1.8B in transaction volume - and the company was valued at almost $4B in its most recent fundraise.

Here's 3 things we can learn from StockX's launch ⬇️

1️⃣ Come for the data, stay for the marketplace. Josh had a massive advantage in launching a resale sneaker marketplace: he had data on millions of transactions from running Campless, and he came up with a smart way to categorize them.

While eBay still housed the majority of transactions, it didn’t provide a single “source of truth” for each SKU. When a seller listed a new pair of sneakers, he or she created an independent product page. Buyers searching for a specific type of shoe saw hundreds of listings at different prices, all titled and labeled differently.

StockX handles this differently. All of the listings for a given sneaker are consolidated on one page, which allows StockX to provide market price and performance history for each SKU. As a result, even sneakerheads who weren’t ready to switch to StockX in the early days would use the site’s data. To paraphrase Chris Dixon, users would “come for the data, and stay for the marketplace.”

StockX leveraged this data advantage to drive more active customer acquisition strategies - a few examples:

Shareable portfolio links that allow users to measure & visualize their investment performance

YouTube videos (and Cheddar appearances) featuring the company’s proprietary data about trending items and supply patterns for various brands

An annual data analysis contest for StockX’s nerdiest fans

2️⃣ It’s OK to “fake” one - or even both - sides of the marketplace. The most difficult part of launching a marketplace business is getting the flywheel going. If a buyer shows up and there’s no inventory to browse, they’ll likely churn. And if a seller makes their first listing and gets no response, they’ll churn as well.

In the early days, StockX used unscalable tactics to ensure that supply and demand joined the platform proportionally. Only “deadstock,” unworn and still-boxed shoes, were eligible to sell - and they had to be ready to ship ASAP. To ensure the platform had enough quality supply, the team had to buy and hold some of the inventory for resale (the tweet below came two weeks before StockX’s public debut).

StockX used a similar strategy to guarantee demand - according to co-founder Greg Schwartz, the team would manually place bids on any shoe that was listed in the early days. In some cases, this meant Greg had to buy the shoes himself and re-list them! But it provided a positive seller experience, which was necessary to compete with eBay and other platforms that had more liquidity. After making a sale, that seller was much more likely to list on StockX again.

3️⃣ Solve for the “hard side”. Pre-StockX, buyers and sellers of sneakers had issues with P2P sites like eBay. Trust was the underlying problem: both sides didn’t want to get scammed. Buyers worried that sneakers weren’t authentic or wouldn’t be shipped, while sellers worried about getting hit with chargebacks or false claims that sneakers were lost in transit or poor quality.

Ultimately though, sellers were the “hard side” - with legitimate supply, buyers will come! The product was designed to appeal to power sellers in a few ways:

Seller fees were waived (or lowered) for much of the first year.

Buyers had to put down a credit card to bid, and sellers received payments after the item was verified at the warehouse - not when it arrived to the buyer.

No chargebacks were allowed from the buyer side, and StockX handled post-verification customer service.

The famous “green tag,” signifying authentication by StockX, became a status symbol for legit items. But there was another purpose. Buyers were asked to do authenticity checks before removing tags, and they were almost impossible to re-attach. The result? As one savvy early StockX buyer pointed out on Reddit, scammers were unable to swap in a fake pair to claim they’d received a counterfeit.

These seller-friendly features were noticed - and appreciated - on sneakerhead forums like SneakerTalk and NikeTalk, where many of the hardcore sellers congregated. Most had been burned by scammers on other P2P resale sites, so positive reviews about how StockX protected sellers went a long way towards building the company’s reputation.

Thanks for reading! I’d love to hear your feedback or requests for companies you’d like me to profile next - you can reach me @omooretweets.

My sources:

“Josh Luber: Love and sneakers (and hip hop). How to turn your passion into profit” - Rebel Radio podcast

“The World’s First Sneaker Stock Market is in Detroit and Could One Day Take on Amazon” - Spencer White

“The Secret Behind Unicorn Success of StockX? Start Before You’re Ready” - Josh Linkner

“Why sneakers are a great investment” - Josh Luber

“Sneaker reseller StockX’s valuation jumps to $3.8 billion” - Frank Holland, Jessica Golden

All views are my own. None of the above should be taken as investment advice. See this page for important information.

Marvelous read!

Interesting read! worked with StockX/DVP on this growth- just sent you a Tweet DM!